PVC and Caustic Soda: A Complex Market Dynamic

Advertisements

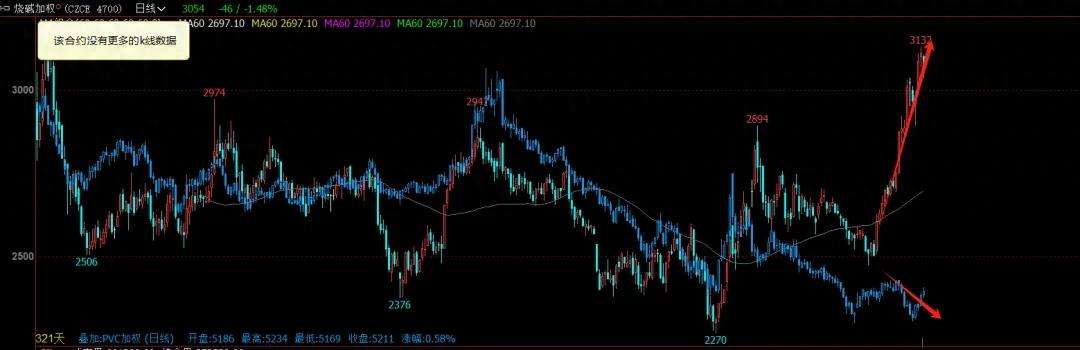

In recent times, the market for caustic soda has been flourishing, capturing the attention of investors and industry players alike. This compound has emerged as a star product, riding high on a wave of demand, reminiscent of the surge observed in the alumina market. However, the contrasting situation of its counterpart, PVC, tells a starkly different story, exemplifying the saying "one is in heaven, the other is in hell."

The question arises: Can PVC make a comeback?

Caustic soda, commonly known as sodium hydroxide, and PVC, or polyvinyl chloride, are key components in the chlor-alkali industry, an essential part of the salt chemical industry. The chain of production for caustic soda begins with the electrolysis of raw salt, yielding caustic soda, hydrogen gas, and chlorine gas. The products derived from caustic soda are versatile, enabling its use across various sectors, including the alumina industry, which is crucial for aluminum production, as well as in textiles, papermaking, and dyeing industries. Furthermore, chlorine has its share of applications, contributing to the production of PVC and hydrochloric acid, among others.

The relationship between caustic soda and PVC can be likened to that of soybean meal and soybean oil, though it is even more closely intertwined. Typically, when the macroeconomic environment is performing well, the demand for both caustic soda and chlorinated products sees a simultaneous uptick in prices. This pattern is analogous to the relationship between soybean prices, where an increase in one often leads to a rise in the prices of both meal and oil.

However, a significant spike in one product can sometimes trigger a downturn in the other. For instance, if we look at the soybean market and consider that the price of soybean oil may increase during the fourth quarter of 2024, manufacturers may push their production towards oil at the expense of soybean meal, leading to an oversupply and subsequently a drop in price, even resulting in losses.

This phenomenon mirrors the current market dynamics for caustic soda and PVC; a surge in caustic soda's market performance could inadvertently push PVC prices down. This divergence often complicates the situation for manufacturers, forcing them to navigate a market fraught with volatility and price fluctuations.

It’s important to understand that the degree of deviation between caustic soda and PVC prices can be quite pronounced. This price disparity is primarily driven by two factors: supply rigidity and demand strength.

On the supply side, chlorine, compared to soy meal, is less manageable due to its high-risk nature, which necessitates its conversion into more stable chemical states like PVC swiftly. This compulsion means that when prices for caustic soda rise, the production for PVC, despite its potential for loss margins, must also increase. Moreover, the interconnected industrial processes mean that the profitability from one area can offset losses in another.

On the demand front, the downstream applications of caustic soda, particularly in alumina production, solidify its necessity. The aluminum sector is characterized by a continuous production cycle, where halting operations incurs heavy costs. The production cost of alumina is only marginally affected by caustic soda prices—around 15-20%—meaning that even when caustic soda prices rise, the industry is unlikely to experience significant pushback, given the margins available further down the value chain.

The state of PVC seems grim. The current PVC prices are reportedly at historic lows, even lower than during the pandemic of 2020. Price points have dipped to levels reminiscent of the significant commodity bear market witnessed in 2015. When adjusting for inflation over the past decade, today's PVC prices are nearing historical lows, leading to widespread industry losses.

In light of this grim outlook, many investors are curious whether now is the right time to "buy the dip." However, the question remains: Can PVC make a rebound?

To explore this, we must first understand what PVC is and its fundamental market conditions. PVC, short for Polyvinyl Chloride, is categorized among the three main synthetic materials—synthetic resins, synthetic fibers, and synthetic rubbers. It ranks as the third most consumed synthetic resin, falling behind polyethylene (PE) and polypropylene (PP).

PVC can be divided into seven grades based on its hardness and performance, including SG1 to SG7. SG4 and below denotes soft products that require significant plasticizers, commonly utilized in synthetic leather, electrical cable insulation, and seals. In contrast, SG5 and above indicates hard products suitable for drainage pipes, electrical fittings, and panels, with pipe demand accounting for nearly 50% of PVC consumption. As such, the demand for PVC is heavily correlated with real estate and infrastructure development.

Currently, the real estate market is faced with significant challenges, and the implications for PVC demand are concerning. The ongoing struggles within the sector, exacerbated by economic pressures, have resulted in a decline in PVC demand, particularly as the market nears the completion phase of construction.

On the production side, PVC can be manufactured through two main processes: the calcium carbide method and the ethylene-based method. While the calcium carbide method dominates domestic production, accounting for over 80% of the market, the ethylene method's share is slowly increasing.

Given that the ethylene method does not hold a significant share, its impact on PVC pricing remains minimal. Thus, focusing on the costs associated with the calcium carbide method is more relevant: the production cost of PVC can be expressed as a combination of various elements, including calcium carbide prices, logistics expenses, and overhead costs like labor and energy consumption.

Within the calcium carbide production process, calcium carbide costs constitute a substantial portion—approximately three-quarters of the total cost—stemming from both coke and lime inputs. Hence, fluctuations in coal prices directly influence PVC manufacturing costs.

Currently, coal prices are decreasing. Observations across various markets reveal that macroeconomic factors play a pivotal role. Understanding supply and demand dynamics, factoring in imports, exports, and production capacities, sheds light on overall market trends. Yet, macro considerations often prove to be the most significant drivers.

The overarching industrial backdrop indicates a less than favorable macroeconomic environment for coal. The steel industry's decline and the emergence of renewable energy pressure on coal-fired generation pose challenges to the market. These factors critically determine the supply-demand balance for numerous commodities.

With surging alumina prices contributing to increasing caustic soda profits, the impetus for reducing PVC production weakens significantly. Moreover, the current bleak demand situation only accentuates the challenges faced by PVC in regaining momentum.

Although the lowest costs currently originate from Inner Mongolia, where rock-bottom coal and electricity prices prevail, production costs still hover around 4500 RMB, factoring in transport expenses. Thus, estimated overall costs reach at least 5000 RMB. It’s vital to remember that mentions of production capacity often overlook total costs; PVC is an industry characterized by high fixed asset investments.

Despite current losses, cash flow remains somewhat positive in this over-saturated market, where profitability has become a luxury while survival is paramount. Sustaining positive cash flow allows companies to continue operations even in adverse circumstances.

However, for investors wary of entering the PVC market, the precarious balance in pricing trends poses a risk. Especially with rising caustic soda prices, navigating trades in the PVC market requires caution and strategic consideration.

For the PVC market to enjoy a resurgence, a combination of extreme pricing levels and sufficient time is essential to allow the supply-demand dynamics to stabilize. The risk reduces significantly if PVC prices settle around 4500 RMB, as this represents a critical threshold for potential trading opportunities.

Until substantial alumina production comes online, PVC remains in a state of flux, and actions aimed solely at bottom fishing in the PVC market are inherently risky. Similarly, any strategic price differential trades require utmost caution within this context.

Looking ahead, investors are left pondering the right moment to re-enter the PVC market. Attaining a clear grasp of the macroeconomic landscape and monitoring the price movements will be crucial as industry conditions continue to evolve.

The PVC market remains tethered to the performance of the broader economy, making any forecasts difficult; however, awareness of key factors influencing pricing can help investors make informed decisions.

Leave A Comment